4 Steps to a Worry-Free Retirement in Canada

An online course for Canadians piecing together their personal retirement puzzle.

Toronto Star

National Post

CBC News

Money Sense

Globe and Mail

Toronto Star

National Post

CBC News

Money Sense

Globe and Mail

Am I Saving Enough?

Calculating your research-based personal retirement nest egg needs

When Can I Retire?

Don't put it off forever!

How Much Can I Take Out of My RRSP and TFSA Each Year?

Learn how to pay yourself each month with minimal taxes

Every year millions of Canadians make two retirement preparation mistakes:

1. They pay a lot of money for bad advice and poor investments.

2. They decide to just keep working hard and leave the planning for later.

Don’t just hope that retirement works out for you.

If you’re looking to retire in the next 20 years, it’s important to take control today.

Retire Earlier, Invest Better,

Withdraw Smarter & Pay Less Tax

What others have to say

Are you on track to

meet your goals?

Why not learn from a real teacher- at your own speed.

Taking control of your own retirement is the only way to quiet that little voice in the back of your head that’ssaying:

Do I need to work one more year? Two more years?

Can we afford to travel after we retire?

Will my pension be there for me when I need it?

Investing scares me - there’s been so much bad news lately - where should I put my money?

How do I turn my nest-egg into a reliable amount of cash that I can spend each month?

Should I downsize my home to get some financial breathing room?

Would I save more taxes if I knew the ins and outs of the RRSP and TFSA?

Will my investments keep pace with the high inflation I see on the news?

What if I need long-term care in later retirement?

Is there anyone who can really explain this money stuff in a way I can understand?

With so many questions, it’s no wonder that most Canadians procrastinate retirement preparation. To make matters worse, financial salespeople are constantly thinking up new ways to siphon off a chunk of your nest-egg each year.

Four Steps to a Worry Free Retirement isn’t about giving you some top secret investing tip that will magically solve all of your problems.

It’s about gradually mastering each piece of your personal retirement puzzle - so that you can finally feel confident in piecing together your own unique solution. No more depending on salespeople who show pretty graphs and use fancy financial terms - but don’t actually help you understand the overall plan.

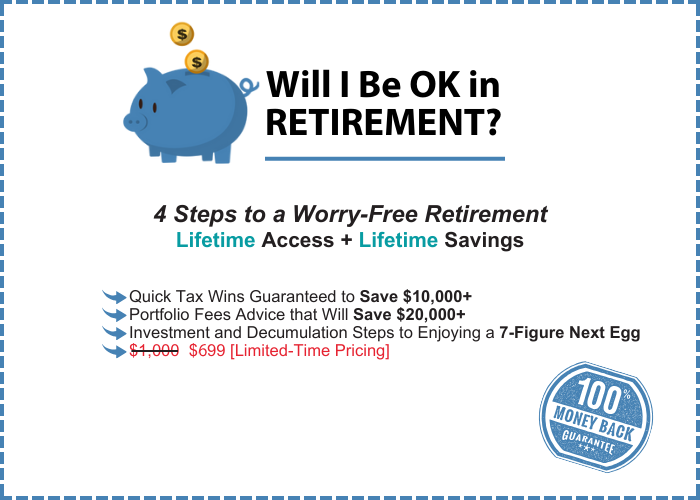

100% Money Back Guarantee

I’m so confident that this course is going to answer your questions - that if you don’t

love it - I’ll give your money back, No Questions Asked.

Try 4 Steps to a Worry-Free Retirement completely risk-free.

Our online course is cheaper than any college or university course (and much more practical).

Likely much less than what you’re already paying in adviser or mutual fund fees!

WhyFour Steps to a Worry-Free Retirementis the right online course for you:

It will be automatically updated every time there is a change to pension rules or tax brackets - unlike books that are outdated after six months.

Course material is a mix of colourful videos, checklists, easy-to-understand examples, expert interviews, transparent research, helpful graphic organizers, and real life steps to take action.

We’ll learn together and get direct answers to our questions using the exclusive Facebook group and the Worry-Free Retirement Study Hall.

You’re learning alongside a certified Canadian personal finance teacher - not relying on some empty suit trying to hurry though a meeting so they can get to their next client.

What Will I Learn?

Course Overview

Meet Your Teacher: Kyle Prevost

Kyle Prevost is an award-winning Canadian teacher. He has been professionally writing about personal finance for over 15 years, and has been featured in publications such as the Globe and Mail, CBC, Million Dollar Journey, Maclean’s, Moneysense, and the National Post.

Prior to becoming a full-time author and speaker, Kyle created his own accredited high school personal finance curriculum - and taught hundreds of students in his Manitoba classroom. He reluctantly credits the pandemic for making him an experienced online educator. He has also recorded over 200 expert interviews as part of hosting the Canadian Financial Summit.

Excelling in helping Canadians of all ages understand their financial options, Kyle strives to build knowledge in a simple, step-by-step manner that helps you take action when it’s most needed.

FAQ: Your Worry Free Retirement

Because rules for programs like CPP or taxes are always changing, books are already out of date by the time they hit bookshelves. This online course will be continuously updated. An online course also offers many more options for video and interview media - which many people find more accessible than hours of reading. Finally, there is no book out there that comes close to the value of being able to ask questions in our private Facebook and course forum groups.

Contact

Hundreds of Canadians are Enjoying a Worry-Free Retirement...

“I never realized how much I was paying in mutual funds fees before taking Kyle’s course. I’m embarrassed to admit that it was over $22,000 every single year - all for mutual funds that had mediocre investment results and a once-per-year meeting that didn’t really answer any of my questions. Never again! Low-fee DIY investments forever!”

Parvinder Singh

Consultant, British Columbia

“I wish I would’ve had this course in high school. Kyle is that teacher that maybe cares a little too much - but that’s a good thing when he’s helping you plan a retirement budget! I appreciated the workbook that I could print off and fill out as I was listening or reading. Now I actually have a physical plan that I can hold and move forward with. Plus - updated information I can come back to whenever I want.”

Grant Gillis

Doctor, Ontario

“I was always wondering how the Canadian pension plans worked and if they’d still be around for me. Now I know exactly how much money I’ll get from CPP and OAS when I retire and how to work that into my overall plan. That alone was worth more than I paid for the course, and it doesn’t even get into the best parts!”

Yan Chow

Project Manager, Alberta

“Kyle - where were you when I was in school??!! This stuff used to

intimidate me, but it’s pretty simple when you break it down into smaller

bites. 5 Stars? 10 Stars? All the Stars!!”

Carly Morris

Architect, British Columbia

I had done a fair bit of research before taking this course, but the sheer volume of information I was coming across was stress inducing to say the least! I just couldn’t put all the financial puzzle pieces put together in an efficient way. I also did not know which pieces were missing! The 4 Steps to a Worry Free Retirement course allowed me to put these pieces together in a logical manner, knowing that I was making decisions based on having all of the information I needed – decisions that were based on my individual situation. I really appreciated the way impartial tradeoffs that were presented (“all sides of the argument”) so that I can make decisions based on my specific situation. If you are on the fence about taking this course, I can only say the savings and strategies presented have incredible value - and they’re lifetime access! The confidence gained is worth every penny!